上海,2020年7月8日

今天,靖亚资本非常高兴地发布“靖亚新兴企业云指数”。

Shanghai, 08 Jul 2020

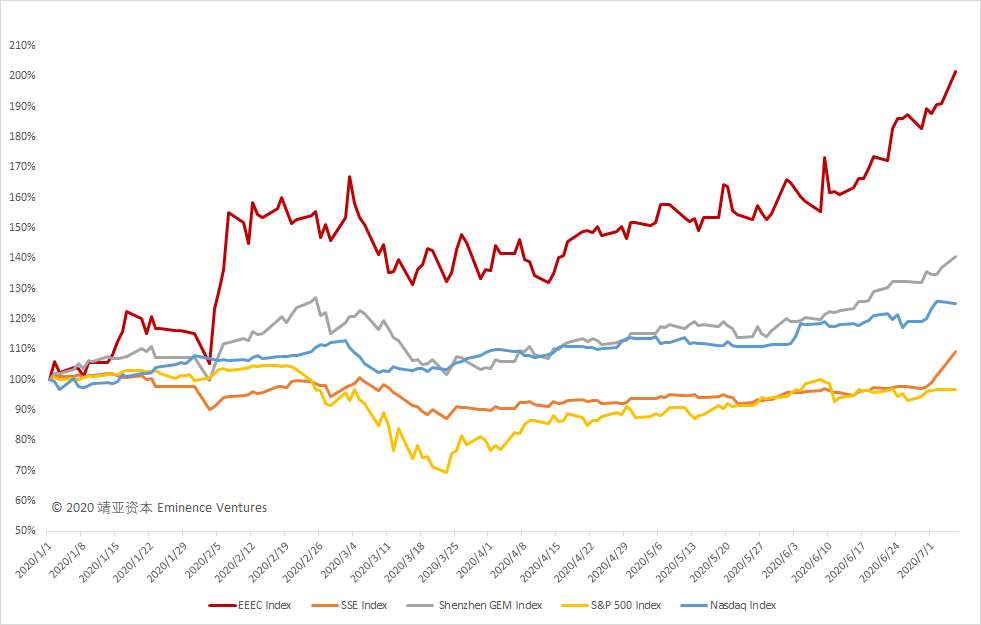

We are happy to announce Eminence Emerging Enterprise Cloud Index (EEEC Index) today.

尽管中国新兴企业云还处在非常早期的阶段,但已经开始进入快速发展期。靖亚资本作为国内聚焦早期企业服务投资的专业机构,为了跟踪、反映中国新兴企业云的市场表现,为市场提供参考基准,借鉴境内外市场的成熟经验,制定并发布本指数。

Although Chinese emerging enterprise cloud is still in its infancy stage, it has already begun to enter rapid development phase. For tracking the performance of Chinese emerging enterprise cloud and providing a market benchmark, Eminence Ventures, the leading venture capital firm laser-focused on early-stage Chinese enterprise companies, designed and published this EEEC Index.

1、指数名称:靖亚新兴企业云指数

1. Index Description: Eminence Emerging Enterprise Cloud Index (EEEC Index)

2、指数基期:2020年1月1日

2. The Index began on 1 Jan 2020

3、指数计算说明:

1) 报告期指数 = 报告期成分股总市值/除数

2) 调整:

当成分股发生变动时,成分股票总市值和除数要做相应调整。

调整后除数=(调整后成分股票总市值/调整前成分股票总市值)x调整前除数

指数基期除数=指数基期成分股总市值/100.00

3. Calculation of index value:

1) Index value = Aggregate Adjusted Market Value/Divisor

2) Adjustments:

When an equity enters or leaves the index, both market value and divisor will be adjusted accordingly.

Divisor = (Market Value after Adjustments/Market Value before Adjustments) x Divisor before Adjustments

Divisor on 1 Jan 2020 = Aggregate Market Value on 1 Jan 2020/100.00

4、成分股调整策略:

每季度由靖亚资本根据市场情况对成分股进行调整。

4. Approach to adjust the index companies:

Eminence Ventures will adjust the index equities quarterly according to the market situation.

5、入选对象与条件:

入选对象——成分股股票必须是上市流通的普通股股票。

入选条件——股票必须满足的条件有:

1) 行业

股票发行人的主要收入由面向企业或组织的软件产品驱动,该软件产品的交付方式包括采用多租户的云服务或采用云计算技术的本地服务。

2) 收入

在上两个财务年度的年收入增长率均超过15%。

3) 其他

在中国大陆、中国香港和美国的市场上市的中国公司股票,最小市值36亿人民币(或38亿港币或5亿美元)。有确定性事件(例如公司申请破产)导致其不能正常自由流通的股票不满足条件。

5. Eligibility

Security Type: Index eligibility is limited to specific security types only. The security types eligible for the Index include public common stocks.

Eligibility Criteria:

1) Industry

The issuer of the security derives the majority of its revenue from business-oriented

software products, as determined by Eminence Ventures, which include cloud service adopting multi-tenant technologies and on-premises service adopting cloud computing technologies.

2) Revenue

The security has grown annual revenue at least 15% for each of the last two full fiscal years, as determined by Eminence Ventures.

3) Security Conditions

- be listed on the China Mainland Market, the China Hong Kong Market, or the U.S. Market

- a minimum market capitalization of 3.6 billion CNY, 3.8 billion HKD, or 500 million USD

- may not have entered into a definitive agreement or other arrangement (ex. bankruptcy) which would likely result in the security no longer being Index eligible

截至2020年7月7日的成分股构成

Index constituents as of 7 Jul 2020

靖亚资本是聚焦早期企业服务的价值创造型VC,专注于投资产品技术驱动的企业服务创业公司。靖亚团队积累了深度的行业认知和洞察、丰富的人脉及经验,能够帮助早期和成长期的创业公司成长,和创业者一起建设伟大的公司。

如需沟通或获取更多信息,请通过电子邮件联络hello@emventures.cn。

© 2020 靖亚资本

Eminence Ventures is a leading venture capital firm dedicated to China’s early-stage enterprise cloud investments. We are a long-term investor to help drive exceptional entrepreneurs who are on a mission to enable enterprises to innovate through products and cloud computing technologies. Our mission is to become the most important venture capital partner for the best entrepreneurs in China’s enterprise market.

For more information, please contact us at hello@emventures.cn.

© 2020 Eminence Ventures